TOKYO-Analysts predict that copper will continue to rise as the global economy dominated by China shows signs of emerging from the COVID-19 recession, despite the insistence of some long-term investors not to participate.

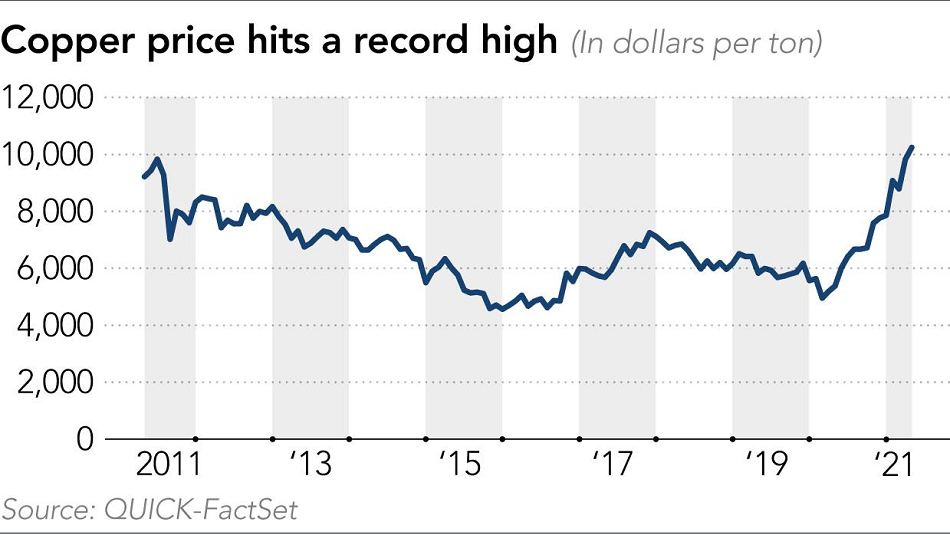

The benchmark copper price of the London Metal Exchange hit a record high at the beginning of May, at US$10,460 per ton, and has remained above US$10,000 since then. The price of copper has not approached this threshold for ten years, and it has almost doubled in a year.

Market analysts are not surprised.

Takayuki Honma, chief economist at Sumitomo global research, said the leap was “expected.”“ Sooner or later, the price will exceed $10000. “

The impact of the epidemic has hardly eased demand for copper, mainly due to China’s rapid recovery.

China is the world’s largest copper buyer, consuming half of the world’s total production. Compared with the same period last year, China’s imports of unwrought copper and products from January to April increased by 9.8%.

”There is almost no reason for copper prices to fall,” said Tetsu Emori, chief executive officer of Emori Fund Management, a Japanese investment consulting firm. Emori pointed out that copper is becoming an attractive commodity for investors, especially as major countries promote decarbonization, which is expected to boost demand for electric vehicles and wind and solar power stations.

Copper is mainly used to make pv cables and is indispensable for infrastructure builders. It won the title of “Doctor” for its extraordinary ability to predict the health of the world economy.

Although the epidemic is not over yet, China’s recovery has triggered the price increase of many commodities. In just one year, the price of iron ore has risen by 78%, and the benchmark price of wood has tripled. The prices of other metals such as nickel and aluminum have also risen. However, the price of aluminum has not soared like the price of copper, so aluminum alloy cables can still be selected for photovoltaic power stations.

Many analysts said that copper prices are unlikely to be much lower than US$8,000 per ton.

”Copper is now exploring a new price equilibrium point,” Honma said. The chief economist of Sumitomo Corporation Global Research predicts that “the new price level of copper will rise by a notch.”

His bullish view is not unfounded.

Goldman Sachs estimates that due to the green transition, copper demand will increase by nearly 600% to 5.4 million tons by 2030. However, by 2030, the market may face a supply gap of 8.2 million tons.

Over the past decade, the development of new mines has been restricted, and mining companies are still cautious about doubling down on investment in new mines amid rising costs.

Promising mines are located where it is difficult to transport large equipment. The increase in environmental awareness has also led to an increase in environmental mitigation costs. Even if the company starts exploring the mine now, it will take at least five years to produce anything.

At the same time, across Asia, due to the increasing demand for copper, the stock prices of mining and trading companies have soared.

The share price of Japanese trading company Marubeni Co., Ltd. has soared by more than 34% since the beginning of the year, while non-ferrous metal producers such as Dowa Holdings and Eneos Holdings have experienced strong gains so far this year.

Similar trends can be seen in other parts of the region. In South Korea, the share price of copper manufacturer Poongsan Corp. has risen by more than 46% this year, while the share price of South Korean Zinc Industry has risen by 16%. The share price of Chinese copper mining company Jiangxi Copper rose 47% in Hong Kong, while the share price of Zijin Mining Group soared 31%.

Funds have flowed into the stocks of related companies because the hope that copper prices will continue to rise has given investors a preference for risk. This is also part of a trend in which investors are shifting from high-growth stocks to cyclical stocks due to the expected economic recovery from the downturn of the new crown pneumonia.

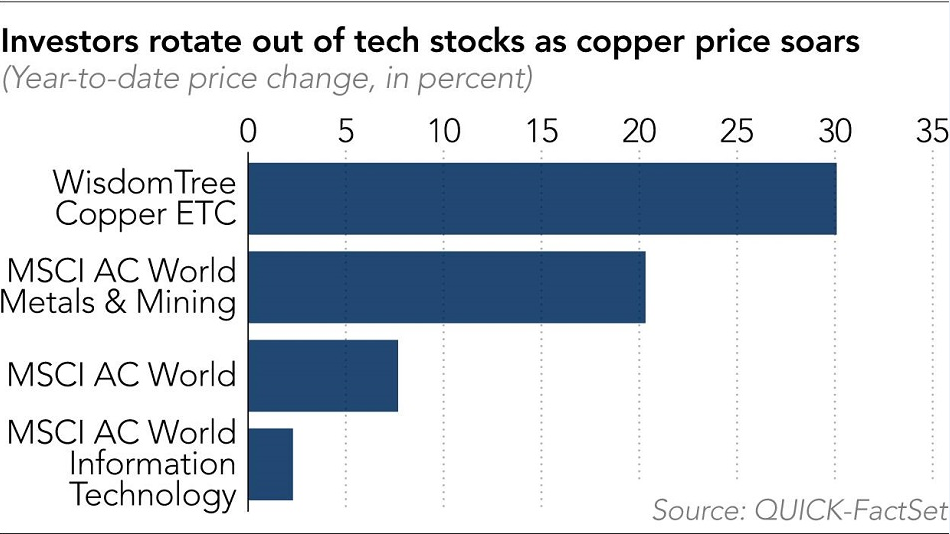

As a result, the mining sector has outperformed technology stocks in recent months.

Compared with the beginning of the year, the stock prices of large technology companies such as Apple and Alibaba are still in the negative region, while the stock prices of Japan’s SoftBank Group and TSMC have only slightly increased.

The MSCI ACWI Metals and Mining Index is composed of large and mid-cap stocks from 23 developed markets and 27 emerging markets. This year, it has risen 20%, which is much higher than the 4% increase of the MSCI ACWI Information Technology Index.

Affected by capital inflows, the returns of copper exchange-traded commodity funds have also risen sharply.

The return rate of WisdomTree Copper ETC in the past year is about 80%, and the assets under management have increased to a record level of over US$900 million. The U.S. Copper Index Fund’s asset management scale exceeds 300 million U.S. dollars, and its one-year return rate exceeds 80%.

Last year, it was reported that Warren Buffett’s Berkshire Hathaway bought a little more than 5% of Marubeni, Sumitomo and three other large traders. Japanese trading companies have attracted global attention.

Warren Buffett, known as a value investor who holds stocks for a long time, said in a statement that the trading company “has many joint ventures around the world, and there are likely to be more. … I hope there will be opportunities for mutual benefit in the future. .”

Commercial banks are deeply involved in the real economy. They provide energy, metals, commodities and a range of other products to Japan, which is scarce in resources.

At the same time, some long-term investors are cautious about investing money in an industry that is heavily dependent on economic conditions and market cycles.

Masafumi Oshiden, head of Japanese equity at New York Mellon Investment Management in Tokyo, said, “According to ESG [Environmental, Social and Governance] standards, it is still difficult to make a positive assessment.”

Companies are under increasing pressure from activists and investors to take action to address climate change, and governments around the world have begun to announce their commitment to decarbonization. Mining companies are being urged to switch to cleaner production processes and are committed to increasing transparency to comply with ESG values.

Oshiden’s investment focuses on the prospect of improving long-term corporate value, and he pointed out that mining companies are not yet suitable for this strategy. “The earnings of trading companies are also difficult to predict,” he said. “They operate in multiple business areas.”